SPDR S&P 500 ETF Trust (SPY)

689.43

+4.95 (0.72%)

NYSE · Last Trade: Feb 22nd, 4:32 AM EST

Markets move on changing belief. Discover how a prediction markets options strategy uses real-time data to improve options trade timing.

Via InvestorPlace · February 21, 2026

In a press briefing, Trump said that he is “ashamed of certain members of the court” for not having the courage to do what’s right for the United States.

Via Stocktwits · February 20, 2026

The Trump administration has been preparing for months for the possibility that the U.S. Supreme court would rule against the president and developed contingency plans as a result, as per a report from NYT.

Via Stocktwits · February 20, 2026

Small Caps Hold Up As Breadth Takes A Breatherchartmill.com

Via Chartmill · February 20, 2026

Breadth Improves, But the Weekly Picture Still Needs Repairchartmill.com

Via Chartmill · February 19, 2026

The firm reportedly said the Trump administration could use Section 122 to impose tariffs of 10% to 15% on most countries.

Via Stocktwits · February 20, 2026

The update comes a day after the President gave Iran 10 to 15 days to strike a nuclear deal.

Via Stocktwits · February 20, 2026

The court said that President Trump exceeded his authority by invoking an emergency-powers law.

Via Stocktwits · February 20, 2026

While PCE was in line with analyst forecasts, core PCE was higher than expectations, according to a Dow Jones estimate.

Via Stocktwits · February 20, 2026

Compared to the third quarter, the deceleration in real GDP in Q4 reflected downturns in government spending and exports and a deceleration in consumer spending, the BEA stated.

Via Stocktwits · February 20, 2026

According to a Reuters report, economists at the Penn-Wharton Budget Model said the potential refund exposure stems from tariffs enacted under the International Emergency Economic Powers Act.

Via Stocktwits · February 20, 2026

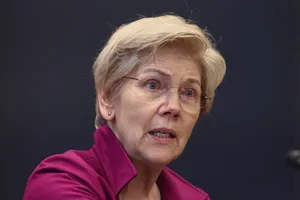

According to a Bloomberg report, Warren said White House National Economic Council Director Kevin Hassett’s criticism of a study by the Federal Reserve Bank of New York did not come as a surprise.

Via Stocktwits · February 20, 2026

The U.S. military has reportedly deployed a vast array of forces in the Middle East, comprising fighter jets, refueling tankers, and two aircraft carriers.

Via Stocktwits · February 20, 2026

Data from Stocktwits indicated retail sentiment on QQQ turned bearish amid elevated message volume.

Via Stocktwits · February 20, 2026

Kratos' stock has more than quadrupled in the last 12 months on the back of several defense and government contracts.

Via Stocktwits · February 20, 2026

In the wake of Blue Owl’s redemption restrictions, Senator Elizabeth Warren called for tighter oversight of private credit.

Via Stocktwits · February 20, 2026

AI slowdown fears, escalating U.S.-Iran tensions, and a range-bound move in Nvidia stock have kept many retail investors cautious and on the sidelines, as market sentiment remains mixed.

Via Stocktwits · February 19, 2026

he Valaris acquisition will enable Transocean to own 73 rigs capable of serving customers in deepwater, harsh-environment, and shallow-water basins around the world.

Via Stocktwits · February 19, 2026

Investors will monitor the first Q4 U.S. economic growth report, covering a period that included the longest federal government shutdown on record.

Via Stocktwits · February 19, 2026

According to a Financial Times report, Kashkari said on Thursday that the Fed was trying to ignore political turbulence and instead focus on its dual mandate of maximum employment and price stability.

Via Stocktwits · February 19, 2026

The United States federal government is teetering on the edge of a significant partial shutdown as a critical funding deadline for the Department of Homeland Security (DHS) arrives tonight, Thursday, February 19, 2026. While much of the federal government remains operational under a broader funding package passed earlier this month,

Via MarketMinute · February 19, 2026

As of February 19, 2026, Southern Company (NYSE: SO) has emerged as one of the most critical infrastructure plays in the United States. Long regarded as a "widows and orphans" stock for its reliable dividends and conservative management, the Atlanta-based utility has undergone a profound transformation. Today, it sits at the epicenter of two of [...]

Via Finterra · February 19, 2026

The President also noted that B-2 bombers went into Iran last year and decimated the country’s nuclear potential.

Via Stocktwits · February 19, 2026

According to data released by the U.S. Department of Labor on Wednesday, jobless claims fell by 23,000 to 206,000 in the week ended February 14.

Via Stocktwits · February 19, 2026

Amazon reported revenue of $716.9 billion in the fiscal year 2025, while its retail rival Walmart posted $713.2 billion in revenue during the year.

Via Stocktwits · February 19, 2026