Shell plc (SHEL)

79.87

+1.93 (2.48%)

NYSE · Last Trade: Feb 18th, 4:47 PM EST

Detailed Quote

| Previous Close | 77.94 |

|---|---|

| Open | 79.60 |

| Bid | 78.70 |

| Ask | 79.97 |

| Day's Range | 79.13 - 79.92 |

| 52 Week Range | 58.54 - 80.25 |

| Volume | 4,626,901 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 2.864 (3.59%) |

| 1 Month Average Volume | 6,570,252 |

Chart

News & Press Releases

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 18, 2026

Living with Alzheimer's disease Di's way

(BPT) - Sponsored by Eisai Inc. and Biogen

Via Brandpoint · February 18, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 17, 2026

LONDON/NEW YORK — February 17, 2026 — Global energy markets are currently suspended in a delicate balancing act as the Islamic Revolutionary Guard Corps (IRGC) concludes its "Smart Control of the Strait of Hormuz" naval exercises. The drills, which included the temporary closure of sections of the world’s most vital

Via MarketMinute · February 17, 2026

Shell PLC (NYSE:SHEL) Presents a Compelling Case for Quality Dividend Investorschartmill.com

Via Chartmill · February 10, 2026

February 17, 2026 The media landscape has reached a fever pitch. Today, Paramount Skydance Corporation (NASDAQ: PSKY) finds itself at the epicenter of a tectonic shift in global entertainment. Following months of speculation and a high-stakes bidding war with Netflix (NASDAQ: NFLX), news has broken that Warner Bros. Discovery (NASDAQ: WBD) has officially reopened acquisition [...]

Via Finterra · February 17, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 16, 2026

As of February 16, 2026, the global energy market finds itself trapped in a violent "tug-of-war" between gravity-defying geopolitical tensions and a relentless structural supply glut. While the International Energy Agency (IEA) has sounded the alarm on a massive projected surplus of nearly 4 million barrels per day (bpd) for

Via MarketMinute · February 16, 2026

As of today, February 16, 2026, the semiconductor industry is witnessing a historic shift, and at the epicenter of this transformation sits Applied Materials, Inc. (Nasdaq: AMAT). Known as the "pick-and-shovel" provider for the digital age, Applied Materials has recently captured the market's full attention following a stunning Q1 2026 earnings report that sent its [...]

Via Finterra · February 16, 2026

The Treasury Department on Friday issued a general license allowing certain large oil companies to invest in new oil-and-gas operations in the Latin American country.

Via Stocktwits · February 13, 2026

NEW YORK — The American consumer engine, long the primary thruster of global economic growth, appears to have sputtered to a complete halt at the close of 2025. In a highly anticipated data release this week that was delayed nearly two months by a historic federal government shutdown, the U.S.

Via MarketMinute · February 13, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 13, 2026

As of February 12, 2026, the financial markets are witnessing a dramatic reversal of the decade-long "growth over value" narrative. In the first six weeks of the year, the S&P 500 Energy sector has surged to become the market's undisputed leader, posting a gain of over 14% and significantly

Via MarketMinute · February 12, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 12, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 11, 2026

As of February 11, 2026, the global energy landscape is teetering on the edge of a significant supply disruption following a series of aggressive maritime interdictions by the United States. On February 9, US naval forces successfully boarded and seized the Aquila II, a crude oil tanker allegedly part of

Via MarketMinute · February 11, 2026

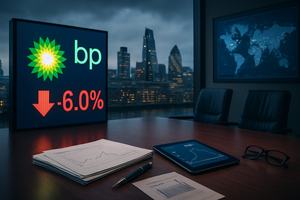

In a move that sent ripples through the global energy sector, BP (NYSE: BP) announced on February 10, 2026, that it would immediately suspend its $750 million quarterly share buyback program. The decision marks a dramatic departure from the company’s recent strategy of aggressive shareholder returns, signaling a pivot

Via MarketMinute · February 10, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 10, 2026

As of February 10, 2026, the global energy landscape finds itself at a crossroads between the urgent demands of decarbonization and the immediate realities of energy security. At the heart of this tension stands BP p.l.c. (NYSE: BP, LSE: BP), a company that has spent the last five years attempting one of the most ambitious [...]

Via Finterra · February 10, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 9, 2026

Via MarketBeat · February 9, 2026

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · February 6, 2026

The global energy market has been jarred by a "violent reversal" in crude oil prices during the first week of February 2026. After a blistering 14% rally in January that saw West Texas Intermediate (WTI) surge to multi-month highs near $67 per barrel, the benchmark has slid approximately 6% in

Via MarketMinute · February 6, 2026

LONDON — Shell, the British energy giant, reported its weakest quarterly profit in nearly five years on February 5, 2026, as a combination of cooling global oil prices and a protracted downturn in the chemicals market finally caught up with the company’s bottom line. The London-based major posted adjusted earnings

Via MarketMinute · February 6, 2026