Allegion plc (ALLE): Securing the Future with a 6% Pre-Market Surge and Seamless Access StrategyOn the morning of February 17, 2026, Allegion plc (

NYSE: ALLE) became the focal point of the industrial and technology sectors as its shares surged nearly 6% in pre-market trading. The catalyst for this significant move was a combination of record-breaking fourth-quarter earnings for 2025 and a surprisingly robust guidance outlook for the 2026 fiscal [...]

1 Mooning Stock Worth Your Attention and 2 Facing HeadwindsEach stock in this article is trading near its 52-week high.

These elevated prices usually indicate some degree of investor confidence, business improvements, or favorable market conditions.

Why Is Ingersoll Rand (IR) Stock Rocketing Higher TodayShares of industrial manufacturing company Ingersoll Rand (

NYSE:IR) jumped 6.1% in the afternoon session after the company reported fourth-quarter 2025 results that surpassed analyst expectations for both revenue and profit.

IR Q4 Deep Dive: Recurring Revenue and M&A Drive Growth Amid Margin PressuresIndustrial manufacturing company Ingersoll Rand (

NYSE:IR) announced better-than-expected revenue in Q4 CY2025, with sales up 10.1% year on year to $2.09 billion. Its non-GAAP profit of $0.96 per share was 6.6% above analysts’ consensus estimates.

Ingersoll Rand (NYSE:IR) Posts Better-Than-Expected Sales In Q4 CY2025Industrial manufacturing company Ingersoll Rand (

NYSE:IR) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 10.1% year on year to $2.09 billion. Its non-GAAP profit of $0.96 per share was 6.6% above analysts’ consensus estimates.

Ingersoll Rand Reports Fourth Quarter and Full-Year 2025 Results

Ingersoll Rand Inc. (

NYSE: IR), a global provider of mission-critical flow creation and life sciences and industrial solutions, reported strong results for both the fourth quarter and the full-year 2025.

Ingersoll Rand Declares Regular Quarterly Cash DividendDAVIDSON, N.C., Feb. 11, 2026 (GLOBE NEWSWIRE) -- The Board of Directors of Ingersoll Rand Inc. (

NYSE: IR), a global provider of mission-critical flow creation and life science and industrial solutions, declared today a regular quarterly cash dividend of $0.02 (two cents) per share of common stock payable on March 26, 2026, to stockholders of record on March 4, 2026.

Earnings To Watch: Ingersoll Rand (IR) Reports Q4 Results TomorrowIndustrial manufacturing company Ingersoll Rand (

NYSE:IR) will be announcing earnings results this Thursday after the bell. Here’s what investors should know.

Hudson Technologies, Alamo, KBR, Trimble, and Ingersoll Rand Stocks Trade Up, What You Need To KnowA number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

What Are Wall Street Analysts' Target Price for Ingersoll Rand Stock?Ingersoll Rand has underperformed the broader market over the past year, and analysts anticipate a modest upside potential from the current price level.

Ingersoll Rand to Participate in Upcoming Investor ConferencesDAVIDSON, N.C., Jan. 27, 2026 (GLOBE NEWSWIRE) -- Ingersoll Rand Inc. (

NYSE: IR), a global provider of mission-critical flow creation and life science and industrial solutions, announced that Vik Kini, chief financial officer, will participate in fireside chats at the following upcoming investor conferences:

2 Large-Cap Stocks Worth Your Attention and 1 Facing ChallengesLarge-cap stocks have the power to shape entire industries thanks to their size and widespread influence.

With such vast footprints, however, finding new areas for growth is much harder than for smaller, more agile players.

3 Unpopular Stocks We Think Twice AboutWhen Wall Street turns bearish on a stock, it’s worth paying attention.

These calls stand out because analysts rarely issue grim ratings on companies for fear their firms will lose out in other business lines such as M&A advisory.

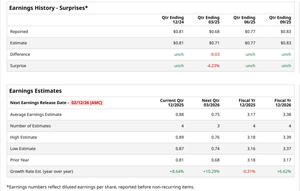

What to Expect From Ingersoll Rand's Next Quarterly Earnings ReportValued at a market cap of $34 billion, Ingersoll Rand Inc. ( IR ) provides various mission-critical air, fluid, energy, and medical technologies services and solutions. The Davidson, North Carolina-based company is ready to announce its fiscal Q4 earnings for 2025 after the market closes on Thursday, Feb. 12.

Ingersoll Rand Schedules Fourth Quarter 2025 Earnings Release and Conference CallDAVIDSON, N.C., Jan. 12, 2026 (GLOBE NEWSWIRE) -- Ingersoll Rand Inc. (

NYSE: IR), a global provider of mission-critical flow creation and life science and industrial solutions, will issue its fourth quarter 2025 earnings release after the market closes on Thursday, February 12, 2026.

3 Reasons to Avoid IR and 1 Stock to Buy InsteadIngersoll Rand has been treading water for the past six months, recording a small loss of 2.4% while holding steady at $85.51. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Worthington, Helios, Ingersoll Rand, Gates Industrial Corporation, and Kennametal Stocks Trade Up, What You Need To KnowA number of stocks jumped in the afternoon session after markets rotated out of tech names to position themselves for a massive injection of government spending.