Ford Motor (F)

14.06

-0.07 (-0.53%)

NYSE · Last Trade: Feb 18th, 1:19 PM EST

Ford is recalibrating its EV strategy and doubling down on affordable EVs at a time when Tesla is pivoting to AI. Would Ford's latest bet pay off amid the EV industry slowdown?

Via Barchart.com · February 18, 2026

The American consumer, long heralded as the invincible engine of the global economy, appears to have finally hit a wall. Newly released data for December 2025 reveals that retail sales saw absolutely no growth, clocking in at a stagnant 0.0% month-over-month change. This "flatline" performance significantly underperformed the 0.

Via MarketMinute · February 18, 2026

As of February 18, 2026, the United States economy is grappling with the most aggressive shift in trade policy since the Great Depression. The Trump administration’s universal baseline tariff has pushed the average import tax to a staggering 13%, a level not seen in nine decades. While the stock

Via MarketMinute · February 18, 2026

The global energy landscape shifted violently this week as crude oil prices plummeted below the $63 per barrel threshold, marking a definitive end to the "war premium" that has propped up markets for over two years. The catalyst for the sell-off was an unexpected confirmation from Israeli Prime Minister Benjamin

Via MarketMinute · February 18, 2026

Despite Fox Corporation's underperformance relative to the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

Via Barchart.com · February 18, 2026

Ford CEO Jim Farley touts the company's Universal EV Platform as crucial to beat Chinese automakers' dominance.

Via Benzinga · February 18, 2026

Lapeer is a small city with plenty to do and a more laid-back vibe than big cities like nearby Detroit.

Via The Motley Fool · February 17, 2026

What's going on in today's session: S&P500 most active stockschartmill.com

Via Chartmill · February 17, 2026

Spotify, Datadog, and Ferrari caught the attention of these investors.

Via The Motley Fool · February 17, 2026

In a dramatic shift for the electric vehicle sector, shares of Rivian Automotive, Inc. (NASDAQ: RIVN) surged more than 26% following a blockbuster fourth-quarter earnings report and confirmed progress on its multi-billion-dollar joint venture with Volkswagen Group (OTC: VWAGY). The rally, which saw the stock climb to $17.73 by

Via MarketMinute · February 17, 2026

LONDON/NEW YORK — February 17, 2026 — Global energy markets are currently suspended in a delicate balancing act as the Islamic Revolutionary Guard Corps (IRGC) concludes its "Smart Control of the Strait of Hormuz" naval exercises. The drills, which included the temporary closure of sections of the world’s most vital

Via MarketMinute · February 17, 2026

Ford CEO proposes joint venture framework with Chinese automakers to manufacture vehicles in the US, amidst shift in auto industry.

Via Benzinga · February 17, 2026

The nuts and bolts of autonomous driving could determine the first big winner of the robotaxi race.

Via The Motley Fool · February 17, 2026

Magna's upbeat report could signal growth for the auto industry as General Motors and Ford show renewed strength.

Via Investor's Business Daily · February 17, 2026

Lattice Semiconductor’s fourth quarter was marked by robust growth, reflecting strong demand in both data center artificial intelligence (AI) and physical AI applications. Management credited the quarter’s performance to expanded adoption of its low-power field-programmable gate arrays (FPGAs), which serve as companion chips in a wide array of systems. CEO Ford Tamer emphasized that Lattice’s solutions are now “being widely adopted at an accelerating rate,” noting that the company’s attach rates and average selling prices both increased. The business also benefited from successful normalization of channel inventory and record design wins across computing and communications sectors.

Via StockStory · February 17, 2026

Ford’s Q4 performance reflected a complex mix of cost headwinds, supply challenges, and evolving product demand. Management highlighted the impact of temporary aluminum supply disruptions, increased tariff expenses, and a deliberate shift in vehicle mix as primary drivers behind the quarter’s results. CEO Jim Farley described the company’s approach as “decisive,” noting progress in cost and quality improvements, the recall of older vehicles to address reliability, and rising U.S. market share. CFO Sherry House acknowledged both material and warranty cost savings, but also pointed to the unplanned Novelis supply chain issues and late-year tariff changes as major factors affecting margins.

Via StockStory · February 17, 2026

In a move that has sent shockwaves through the global battery metals sector, Albemarle Corporation (NYSE:ALB) officially announced on February 11, 2026, that it will idle the remaining operations at its flagship Kemerton lithium hydroxide plant in Western Australia. This decision marks the final chapter in a multi-year restructuring

Via MarketMinute · February 16, 2026

In the past five years, this Detroit auto stock underperformed the S&P 500.

Via The Motley Fool · February 16, 2026

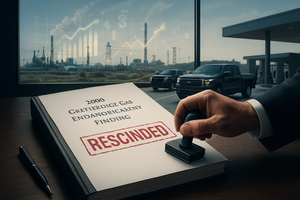

In a move that has sent shockwaves through the global automotive and energy markets, the Environmental Protection Agency (EPA) finalized a rule on February 12, 2026, rescinding the landmark 2009 Greenhouse Gas Endangerment Finding. This historic decision effectively dismantles the legal foundation for federal greenhouse gas (GHG) regulations under the

Via MarketMinute · February 16, 2026

On February 16, 2026, the electric vehicle (EV) sector witnessed a seismic shift in investor sentiment as Rivian Automotive (NASDAQ: RIVN) surged by 26.6% in a single trading session. This dramatic rally, which pushed the stock to $17.73, followed a blockbuster 2026 outlook and a series of strategic partnership headlines that have effectively silenced long-standing [...]

Via Finterra · February 16, 2026

The company's vision of the transportation market is revolutionary, and the company is betting big on it.

Via The Motley Fool · February 16, 2026

Nio and Rivian are both relatively young EV producers, but the market conditions they're faced with could not be more different.

Via The Motley Fool · February 16, 2026

This week featured major business and political developments, including Tesla's semi pricing undercutting competitors, the Trump administration's rollback of EPA regulations, the Pentagon's addition of Alibaba and BYD to a Chinese military list, Ford's $7 billion EV charge forecast, and Waymo's potential $2.5 billion deal with Hyundai.

Via Benzinga · February 15, 2026

Turning around its business in Europe will be a big win, but what it could learn from a Chinese rival might be even more valuable.

Via The Motley Fool · February 14, 2026

Turning around its business in China is important to General Motors and its investors, and there's a little good news in that area.

Via The Motley Fool · February 14, 2026