USA Rare Earth, Inc. - Common Stock (USAR)

19.82

-1.05 (-5.03%)

NASDAQ · Last Trade: Mar 3rd, 2:40 PM EST

Detailed Quote

| Previous Close | 20.87 |

|---|---|

| Open | 19.59 |

| Bid | 19.79 |

| Ask | 19.82 |

| Day's Range | 19.08 - 20.41 |

| 52 Week Range | 5.560 - 43.98 |

| Volume | 7,015,999 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 19,557,264 |

Chart

News & Press Releases

EQNX::TICKER_START (NASDAQ:ALOY)(NYSE:VALE),(NYSE:UUUU),(NYSE:MP),(NASDAQ:CRML),(NASDAQ:USAR) EQNX::TICKER_END

Via FinancialNewsMedia · March 3, 2026

The allure of this rare-earth stock continues to attract investors.

Via The Motley Fool · March 2, 2026

This company is helping resolve a key strategic rare earth supply chain problem for the U.S.

Via The Motley Fool · February 27, 2026

USA Rare Earth could fix a hole in the U.S. supply chain.

Via The Motley Fool · February 25, 2026

In a move that signals a radical shift in American industrial policy, the Trump administration has officially finalized a $1.6 billion investment package in USA Rare Earth (NASDAQ: USAR), including a direct 10% equity stake for the federal government. The announcement, made through the Department of Commerce on January

Via MarketMinute · February 25, 2026

This rare-earth magnet producer presents an attractive opportunity for long-term investors.

Via The Motley Fool · February 19, 2026

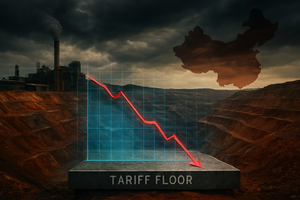

The U.S. is working on a critical minerals price-floor system to strengthen supply chains for resources considered vital to national security, according to a Bloomberg report.

Via Stocktwits · February 18, 2026

The rare-earth company was approved for federal funding to expand its processing and mining capabilities. Here's what investors have to look forward to.

Via The Motley Fool · February 17, 2026

The U.S. government is backing the company to produce materials crucial to America's security and interests.

Via The Motley Fool · February 17, 2026

USA Rare Earth is up over 60% in 2026. Is now the time to invest $1,000?

Via The Motley Fool · February 15, 2026

USA Rare Earth is beating the market so far in 2026. Could it make you a millionaire?

Via The Motley Fool · February 14, 2026

MP Materials and USA Rare Earth are solving the same problem. Which one will make investors rich over the long term?

Via The Motley Fool · February 14, 2026

President Trump's Project Vault has rare earth stocks surging. Here are 7 critical questions about which mining stocks could benefit from the $12B initiative.

Via InvestorPlace · February 13, 2026

The domestic critical minerals market has been set ablaze this February as shares of USA Rare Earth (NASDAQ: USAR) experienced a historic rally, surging more than 60% year-to-date. This explosive movement stems from a powerful confluence of massive federal intervention and high-level financial speculation. At the heart of the frenzy

Via MarketMinute · February 13, 2026

The U.S. government continues to support the domestic rare-earth industry, and that's good news for MP Materials.

Via The Motley Fool · February 13, 2026

USA Rare Earth stock has already gained 62% in 2026. Is now your chance to buy?

Via The Motley Fool · February 13, 2026

Consider any near-term weakness a buying opportunity for this rare-earth elements stock.

Via The Motley Fool · February 13, 2026

Securing a domestic supply of critical rare-earth materials and magnets is a priority for the current administration, which means USA Rare Earth is in favor.

Via The Motley Fool · February 12, 2026

USA Rare Earth just got a big financial boost from Uncle Sam, but it doesn't change this key fact about the business.

Via The Motley Fool · February 11, 2026

Is this deal as good as it seems for USA Rare Earth?

Via The Motley Fool · February 10, 2026

Via MarketBeat · February 9, 2026

These mining stocks could help you hit pay dirt.

Via The Motley Fool · February 9, 2026

USA Rare Earth stock has been red hot over the last year. What comes next?

Via The Motley Fool · February 7, 2026

The periodic table never looked so lucrative. These three mining stocks want to capture the upside.

Via The Motley Fool · February 7, 2026

In a move that has sent shockwaves through global commodities markets, rare earth and critical materials stocks suffered a sharp sell-off this week following the U.S. administration's announcement of a "tariff floor" policy. The new regulatory framework, unveiled by Vice President J.D. Vance during a Critical Minerals Ministerial

Via MarketMinute · February 5, 2026