Nova Minerals Limited - American Depositary Shares (NVA)

6.5000

-0.0400 (-0.61%)

NASDAQ · Last Trade: Feb 19th, 12:21 AM EST

Detailed Quote

| Previous Close | 6.540 |

|---|---|

| Open | 6.600 |

| Bid | 6.520 |

| Ask | 6.540 |

| Day's Range | 6.480 - 6.850 |

| 52 Week Range | 1.680 - 16.28 |

| Volume | 771,814 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 980,684 |

Chart

About Nova Minerals Limited - American Depositary Shares (NVA)

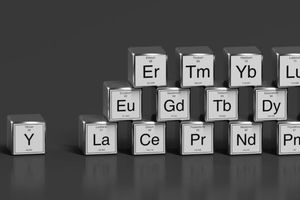

Nova Minerals Limited is a resource exploration and development company focused on identifying and advancing precious and base metal projects. The company is primarily engaged in mining activities, with a particular emphasis on gold and silver, leveraging advanced exploration techniques to assess the mineral potential of its properties. Nova Minerals aims to unlock value through strategic acquisitions, exploration successes, and partnerships, while adhering to sustainable and responsible practices in its operations. Through its portfolio of mining projects, the company seeks to contribute to the global demand for critical resources and capitalize on opportunities within the mining sector. Read More

News & Press Releases

The market is filled with gapping stocks in Friday's session.chartmill.com

Via Chartmill · January 9, 2026

Before the US market kicks off on Friday, let's examine the pre-market session and unveil the notable performers among the top gainers and losers.

Via Chartmill · December 19, 2025

MarketNewsUpdates News Commentary

By MarketNewsUpdates.com · Via GlobeNewswire · December 8, 2025

EQNX::TICKER_START (OTCID:XTPT),(OTCPK:XTPT),(OTCQB:DTREF),(NYSE:TECK),(NASDAQ:NVA),(NASDAQ:CRML) EQNX::TICKER_END

Via FinancialNewsMedia · December 8, 2025

ORLANDO, FLORIDA / ACCESS Newswire / December 5, 2025 / RedChip Companies will air interviews with Calidi Biotherapeutics, Inc. (NYSE American:CLDI) and Nova Minerals Limited (Nasdaq:NVA) on the RedChip Small Stocks, Big Money™ show, a sponsored program on Bloomberg TV this Saturday, December 6, at 7 p.m. Eastern Time (ET). Bloomberg TV is available in an estimated 73 million homes across the U.S.

Via ACCESS Newswire · December 5, 2025

ORLANDO, FLORIDA / ACCESS Newswire / November 26, 2025 / RedChip Companies, an industry leader in investor relations, media, and research for microcap and small-cap companies, today announced its upcoming Metals & Mining: The Race to Onshore Critical Minerals Virtual Investor Conference, taking place December 10, 2025, from 9:30 a.m. to 4:00 p.m. ET. The conference offers investors a front-row seat to the public companies driving exploration, development, and production across the rapidly evolving critical minerals sector.

Via ACCESS Newswire · November 26, 2025

Curious to know what's happening on the US markets one hour before the close of the markets on Friday? Join us as we explore the top gainers and losers in today's session.

Via Chartmill · November 7, 2025

Keep an eye on the top gainers and losers in Friday's session, as they reflect the most notable price movements.

Via Chartmill · November 7, 2025

Stay up-to-date with the latest market trends one hour before the close of the markets on Tuesday. Explore the top gainers and losers during today's session in our detailed report.

Via Chartmill · October 21, 2025

Which stocks have an unusual volume on Tuesday?

Via Chartmill · October 21, 2025

Keep an eye on the top gainers and losers in Tuesday's session, as they reflect the most notable price movements.

Via Chartmill · October 21, 2025

Traders are paying attention to the gapping stocks in Tuesday's session. Let's dive into which stocks are experiencing notable gaps.

Via Chartmill · October 21, 2025

Let's have a look at what is happening on the US markets one hour before the close of the markets on Monday. Below you can find the top gainers and losers in today's session.

Via Chartmill · October 20, 2025

Via Benzinga · October 16, 2025

Unusual volume stocks are being observed in Thursday's session.

Via Chartmill · October 16, 2025

Curious about what's happening in today's session? Check out the latest stock movements and price changes.

Via Chartmill · October 16, 2025

Via Benzinga · October 16, 2025

Via Benzinga · October 15, 2025

Via Benzinga · October 15, 2025

Via Benzinga · October 15, 2025

WMT, NVA, ALAB, TMQ, STLA were among the top trending stocks on Tuesday, Oct. 14, 2025.

Via Benzinga · October 14, 2025

Intrigued by the market activity one hour before the close of the markets on Tuesday? Uncover the key winners and losers of today's session in our insightful analysis.

Via Chartmill · October 14, 2025

This rare earth stock is seeing a rare pause in climbing higher today.

Via The Motley Fool · October 14, 2025

Nova Minerals Ltd. surges after being invited to brief governments on critical minerals project in Alaska ahead of high-level talks.

Via Benzinga · October 14, 2025