Video game publisher Take Two (NASDAQ:TTWO) announced better-than-expected revenue in Q2 CY2025, with sales up 12.4% year on year to $1.50 billion. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $1.68 billion was less impressive, coming in 1.2% below expectations. Its GAAP loss of $0.07 per share was 90.2% above analysts’ consensus estimates.

Is now the time to buy Take-Two? Find out by accessing our full research report, it’s free.

Take-Two (TTWO) Q2 CY2025 Highlights:

- Revenue: $1.50 billion vs analyst estimates of $1.38 billion (12.4% year-on-year growth, 9.3% beat)

- EPS (GAAP): -$0.07 vs analyst estimates of -$0.72 (90.2% beat)

- The company lifted its revenue guidance for the full year to $6.15 billion at the midpoint from $6 billion, a 2.5% increase

- EPS (GAAP) guidance for the full year is -$2.22 at the midpoint, beating analyst estimates by 10.4%

- EBITDA guidance for the full year is $583.5 million at the midpoint, below analyst estimates of $885.5 million

- Operating Margin: 1.4%, up from -13.8% in the same quarter last year

- Free Cash Flow was -$69.8 million, down from $224.9 million in the previous quarter

- Market Capitalization: $41.91 billion

Company Overview

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

Revenue Growth

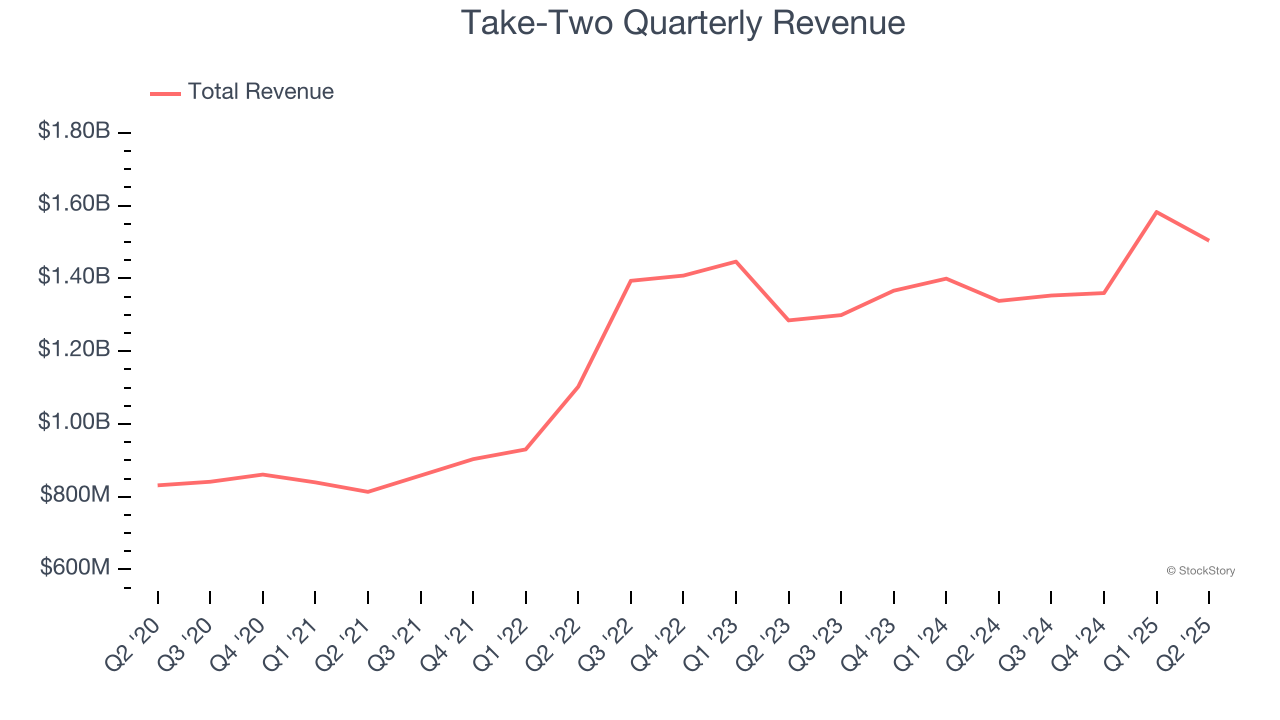

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Take-Two’s 15.2% annualized revenue growth over the last three years was solid. Its growth beat the average consumer internet company and shows its offerings resonate with customers.

This quarter, Take-Two reported year-on-year revenue growth of 12.4%, and its $1.50 billion of revenue exceeded Wall Street’s estimates by 9.3%. Company management is currently guiding for a 23.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 30.6% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

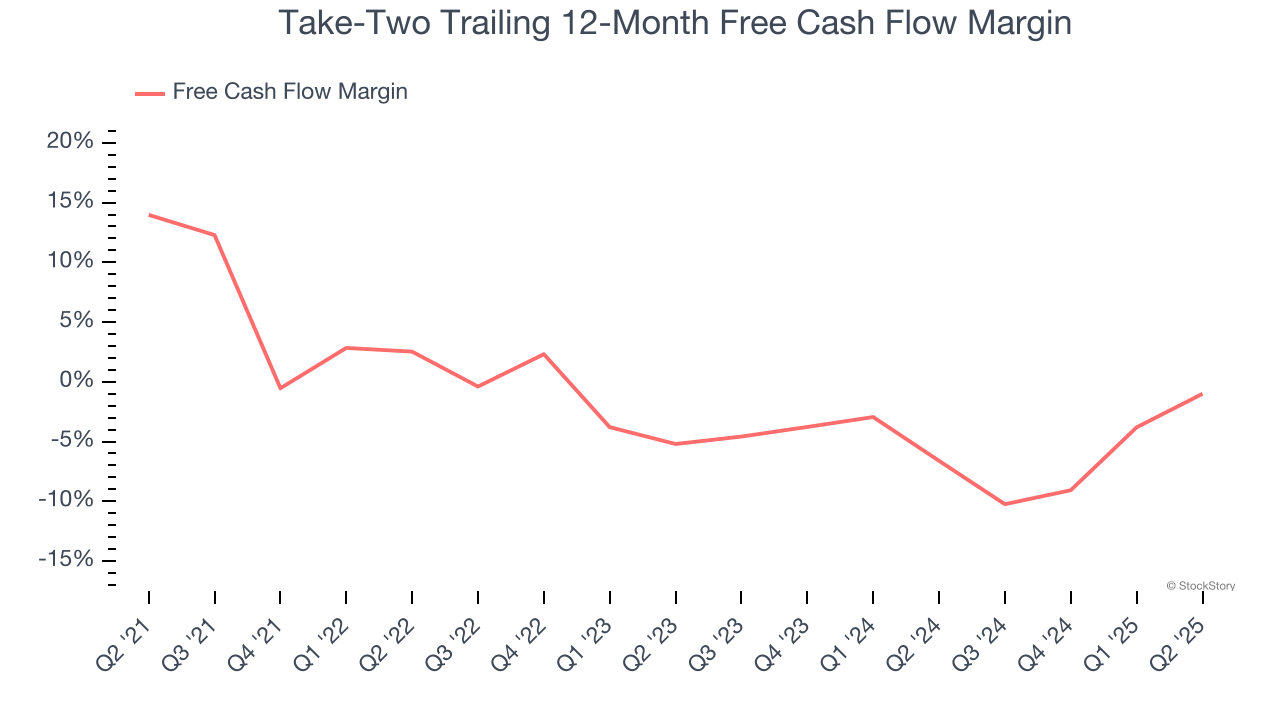

Take-Two’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 3.7%. This means it lit $3.71 of cash on fire for every $100 in revenue. This is a stark contrast from its EBITDA margin, and its investments (i.e., stocking inventory, building new facilities) are the primary culprit.

Taking a step back, we can see that Take-Two’s margin dropped by 3.5 percentage points over the last few years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s in the middle of an investment cycle.

Take-Two burned through $69.8 million of cash in Q2, equivalent to a negative 4.6% margin. The company’s cash burn slowed from $226.1 million of lost cash in the same quarter last year.

Key Takeaways from Take-Two’s Q2 Results

We were impressed by how significantly Take-Two blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 4.6% to $237 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.