Hospitality company Hyatt Hotels (NYSE:H) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 6.2% year on year to $1.81 billion. Its non-GAAP profit of $0.68 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy Hyatt Hotels? Find out by accessing our full research report, it’s free.

Hyatt Hotels (H) Q2 CY2025 Highlights:

- Revenue: $1.81 billion vs analyst estimates of $1.72 billion (6.2% year-on-year growth, 4.8% beat)

- Adjusted EPS: $0.68 vs analyst estimates of $0.67 (1.8% beat)

- Adjusted EBITDA: $303 million vs analyst estimates of $291.4 million (16.8% margin, 4% beat)

- EBITDA guidance for the full year is $1.11 billion at the midpoint, below analyst estimates of $1.12 billion

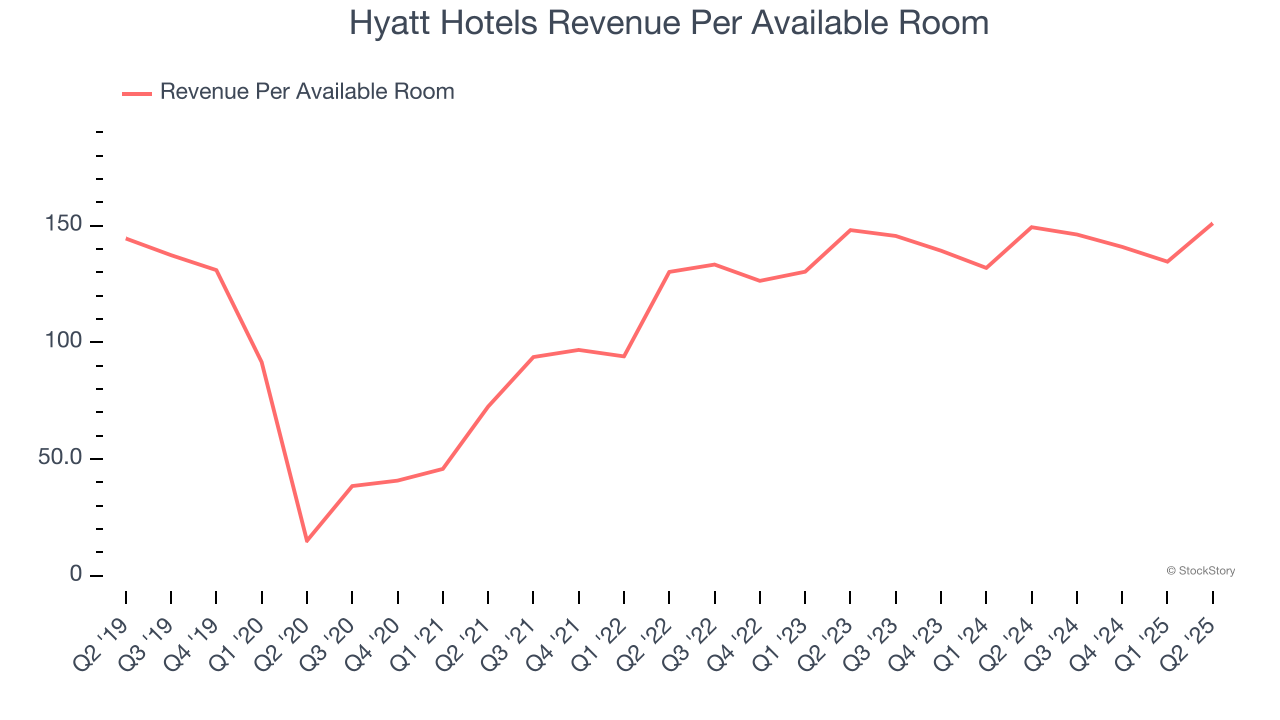

- RevPAR: $150.97 at quarter end, up 1.1% year on year

- Market Capitalization: $12.99 billion

Company Overview

Founded in 1957, Hyatt Hotels (NYSE:H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Revenue Growth

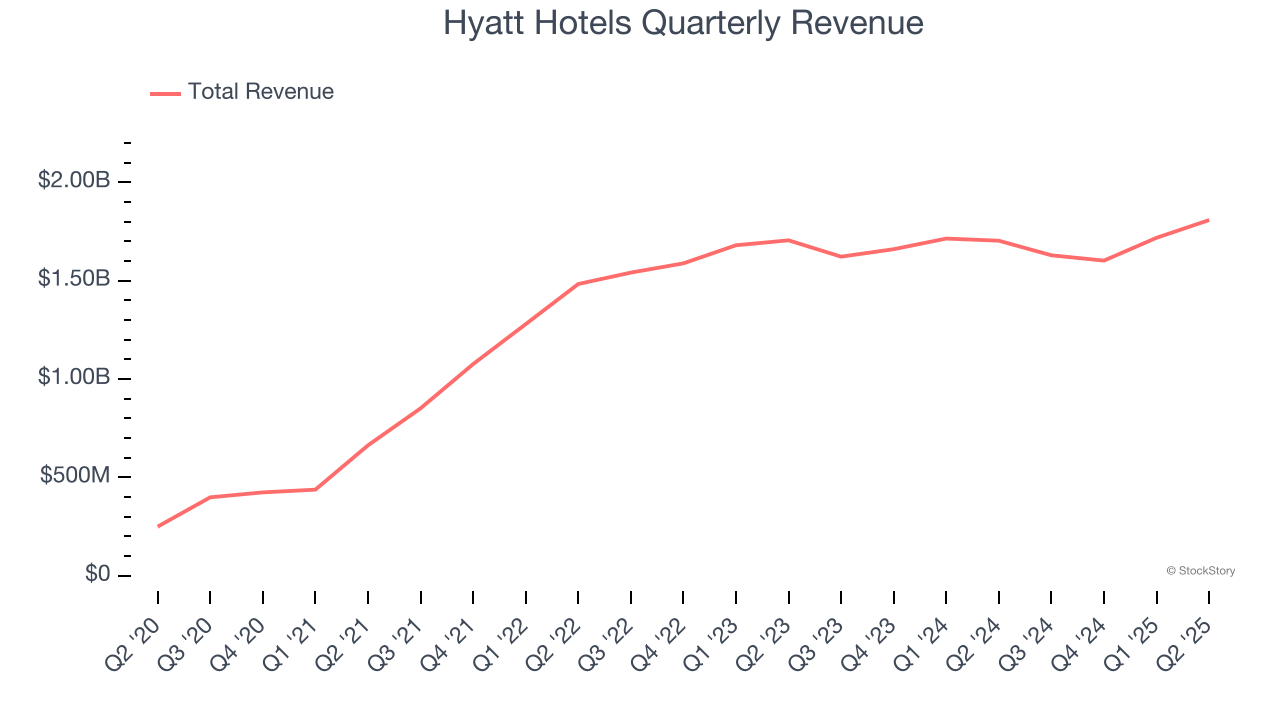

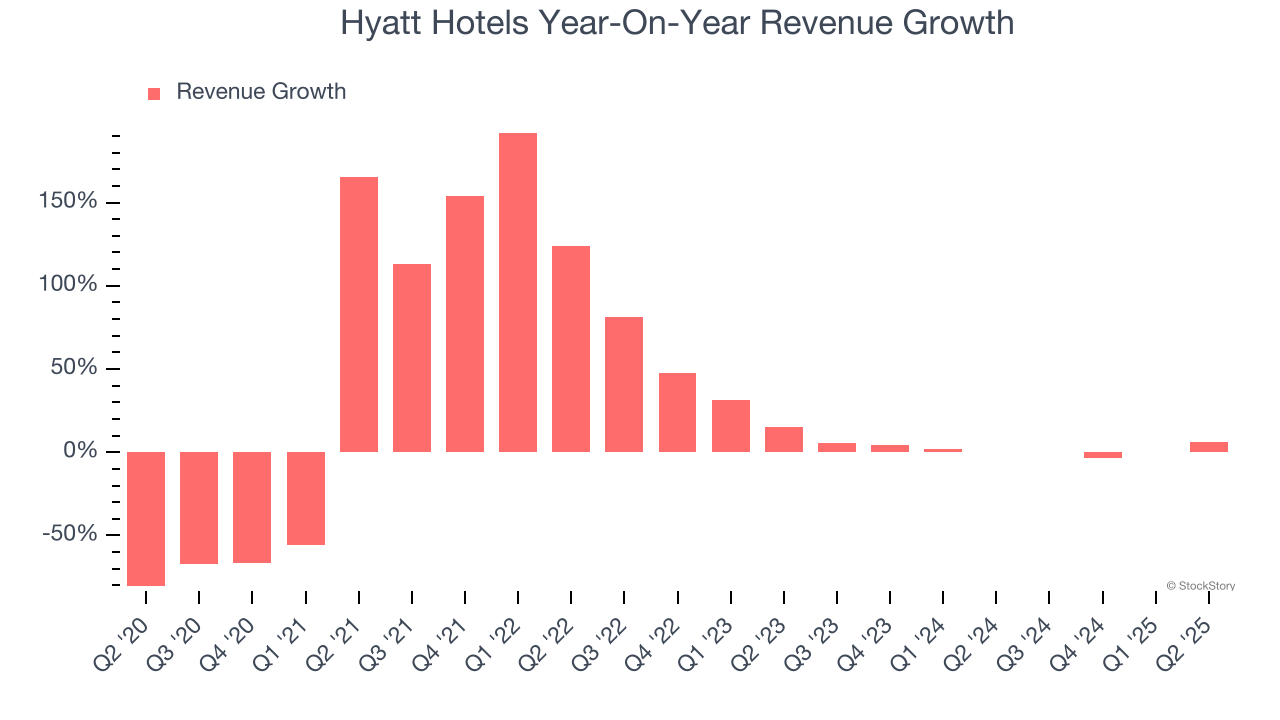

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Hyatt Hotels grew its sales at a 12.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Hyatt Hotels’s recent performance shows its demand has slowed as its annualized revenue growth of 1.8% over the last two years was below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $150.97 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Hyatt Hotels’s revenue per room averaged 3.3% year-on-year growth. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Hyatt Hotels reported year-on-year revenue growth of 6.2%, and its $1.81 billion of revenue exceeded Wall Street’s estimates by 4.8%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

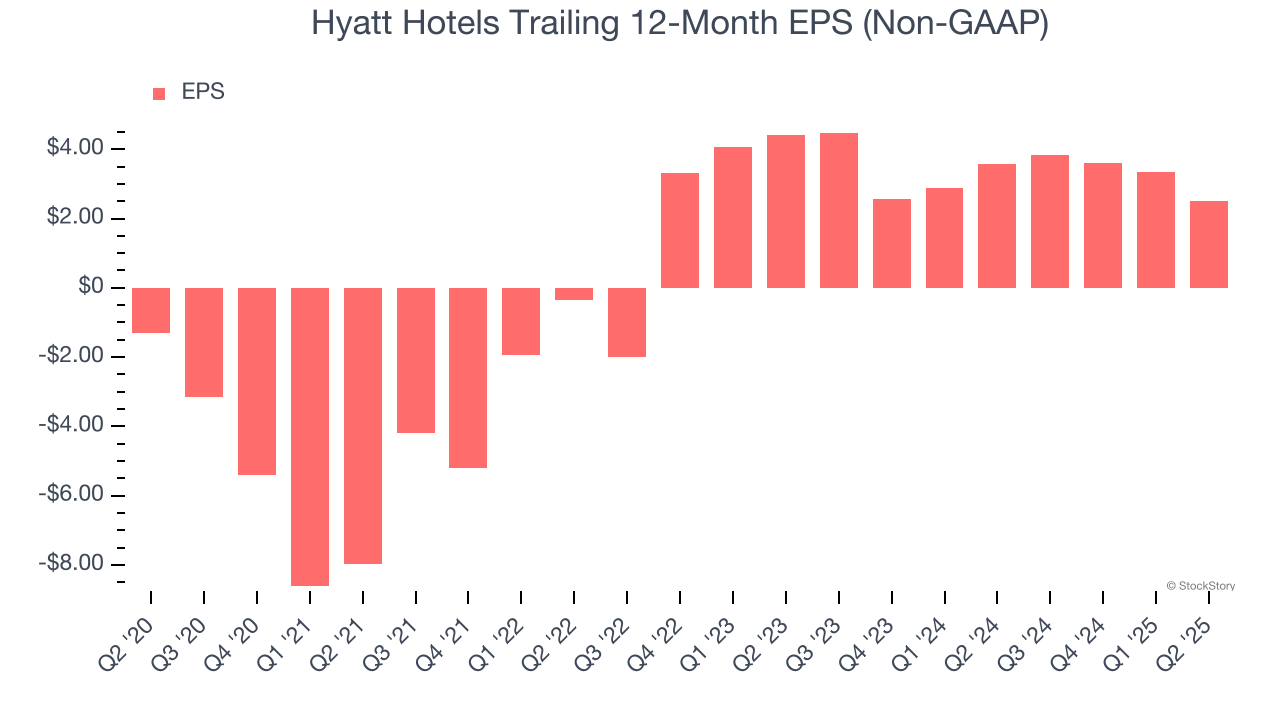

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hyatt Hotels’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, Hyatt Hotels reported adjusted EPS at $0.68, down from $1.53 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects Hyatt Hotels’s full-year EPS of $2.50 to grow 23.3%.

Key Takeaways from Hyatt Hotels’s Q2 Results

We enjoyed seeing Hyatt Hotels beat analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed. Overall, this print had some key positives. The stock traded up 1.2% to $138.29 immediately following the results.

So do we think Hyatt Hotels is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.