Funeral services company Carriage Services (NYSE:CSV) announced better-than-expected revenue in Q2 CY2025, but sales were flat year on year at $102.1 million. The company’s full-year revenue guidance of $415 million at the midpoint came in 1.7% above analysts’ estimates. Its non-GAAP profit of $0.74 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy Carriage Services? Find out by accessing our full research report, it’s free.

Carriage Services (CSV) Q2 CY2025 Highlights:

- Revenue: $102.1 million vs analyst estimates of $101.4 million (flat year on year, 0.8% beat)

- Adjusted EPS: $0.74 vs analyst estimates of $0.73 (1.8% beat)

- Adjusted EBITDA: $32.26 million vs analyst estimates of $31.49 million (31.6% margin, 2.5% beat)

- The company lifted its revenue guidance for the full year to $415 million at the midpoint from $405 million, a 2.5% increase

- Management raised its full-year Adjusted EPS guidance to $3.25 at the midpoint, a 1.6% increase

- EBITDA guidance for the full year is $131.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 23.5%, up from 18% in the same quarter last year

- Free Cash Flow Margin: 6.8%, up from 1.7% in the same quarter last year

- Market Capitalization: $725.2 million

Carlos Quezada, Vice Chairman and CEO, stated, “We are pleased with our second quarter performance, which delivered an impressive GAAP net income growth of $5.5 million, or 85.7%, over the prior year quarter. Our GAAP diluted EPS reached $0.74, and adjusted diluted EPS of $0.74, compared to $0.40 and $0.63 in the prior quarter, reflecting growth of 85.0% and 17.5%, respectively. Despite the revenue impact of our first quarter divestitures, total revenue remained flat due to the impact of our organic growth strategies. Excluding the impact of divestitures, revenue increased $1.8 million, or 1.7%. After over two years of disciplined capital allocation, where we were able to pay just over $100 million of debt, we are excited to announce that we are under contract to acquire new businesses, which we anticipate will close this quarter. Combined, these premier locations served more than 2,600 families and generated more than $15 million in revenue last year. We are excited to return to our long-term strategy of adding shareholder value through high-quality acquisitions. Therefore, we are updating our full-year guidance to reflect our current performance trends, as well as divestitures and acquisitions that will impact the second half of the year,” concluded Mr. Quezada.

Company Overview

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Revenue Growth

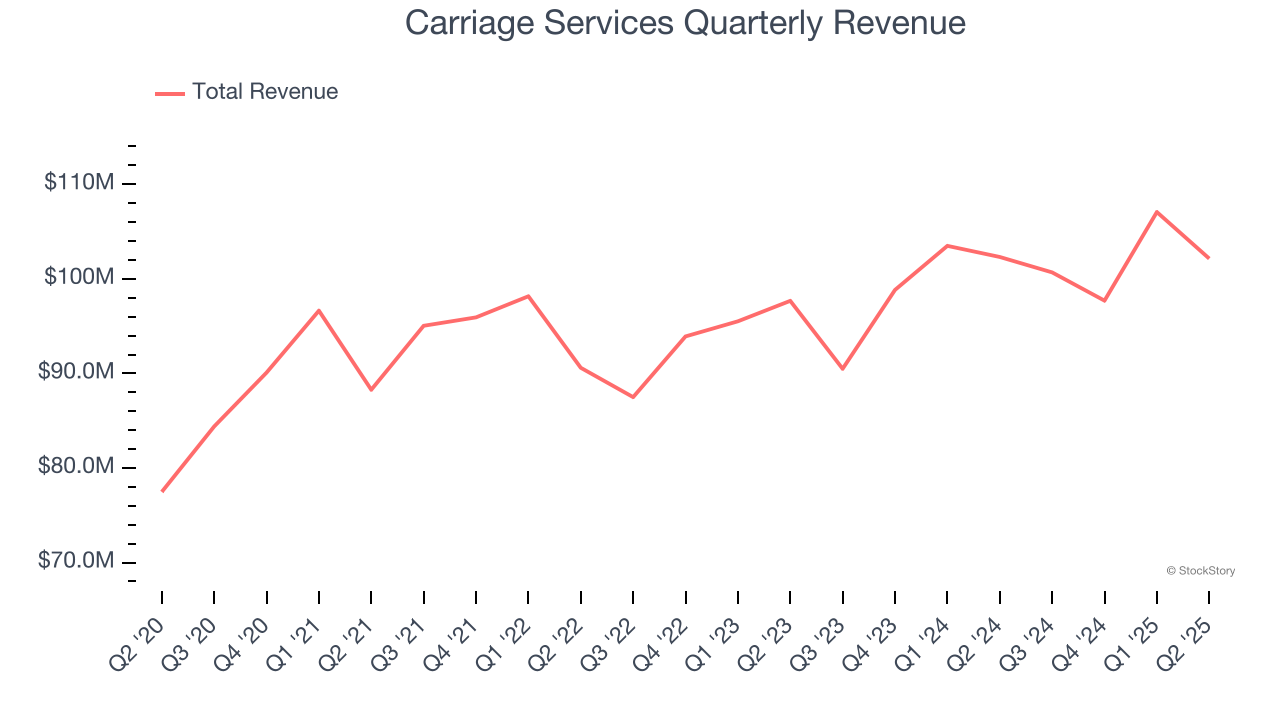

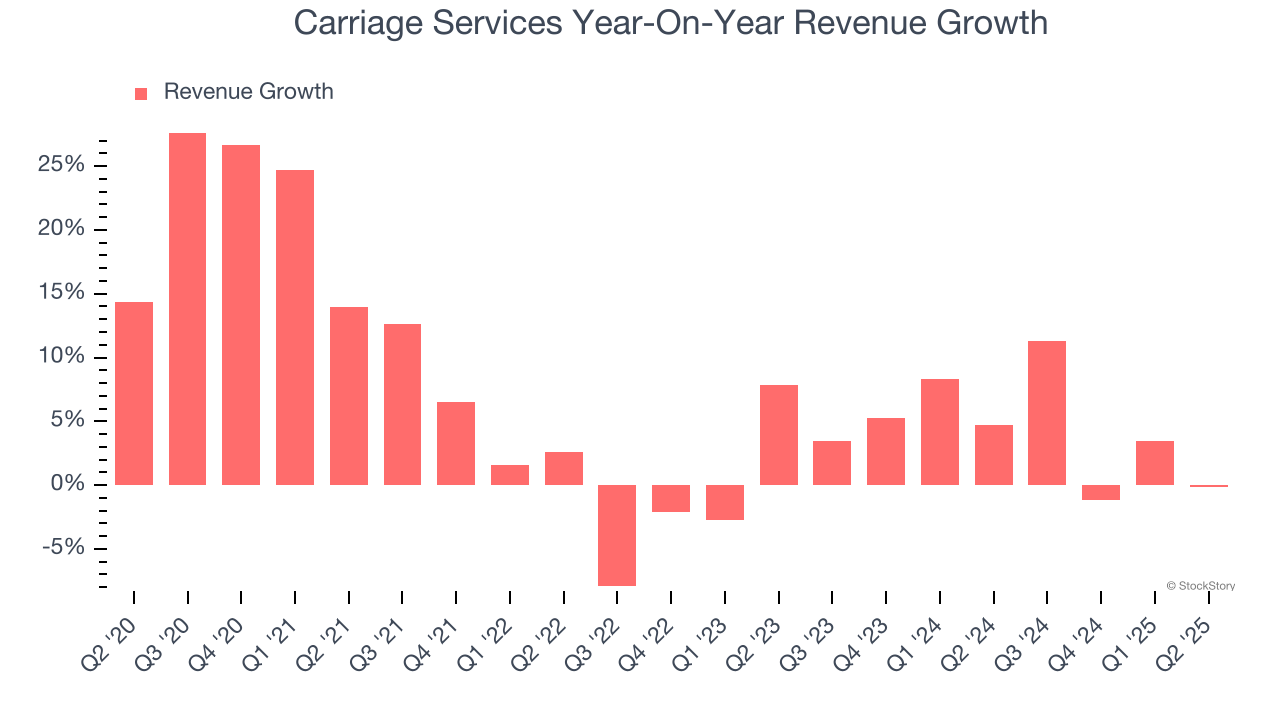

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Carriage Services grew its sales at a sluggish 6.9% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Carriage Services’s recent performance shows its demand has slowed as its annualized revenue growth of 4.3% over the last two years was below its five-year trend.

This quarter, Carriage Services’s $102.1 million of revenue was flat year on year but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

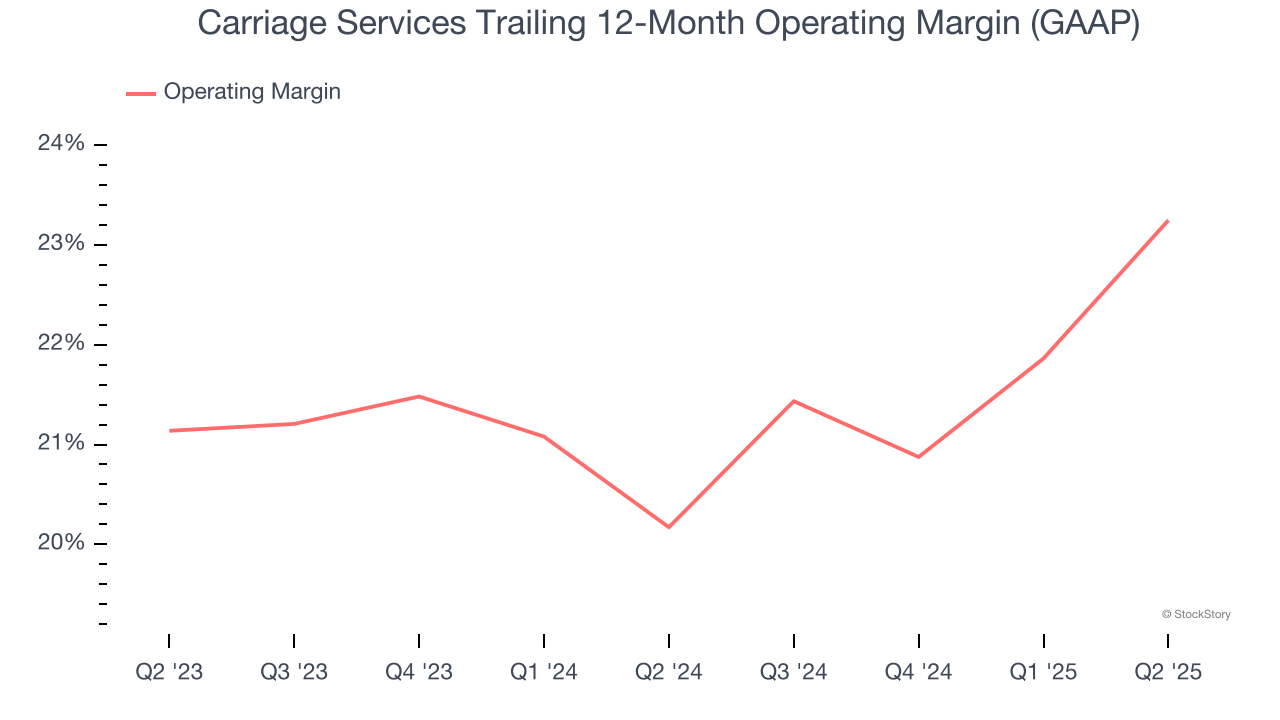

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Carriage Services’s operating margin has risen over the last 12 months and averaged 21.7% over the last two years. On top of that, its profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Carriage Services generated an operating margin profit margin of 23.5%, up 5.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

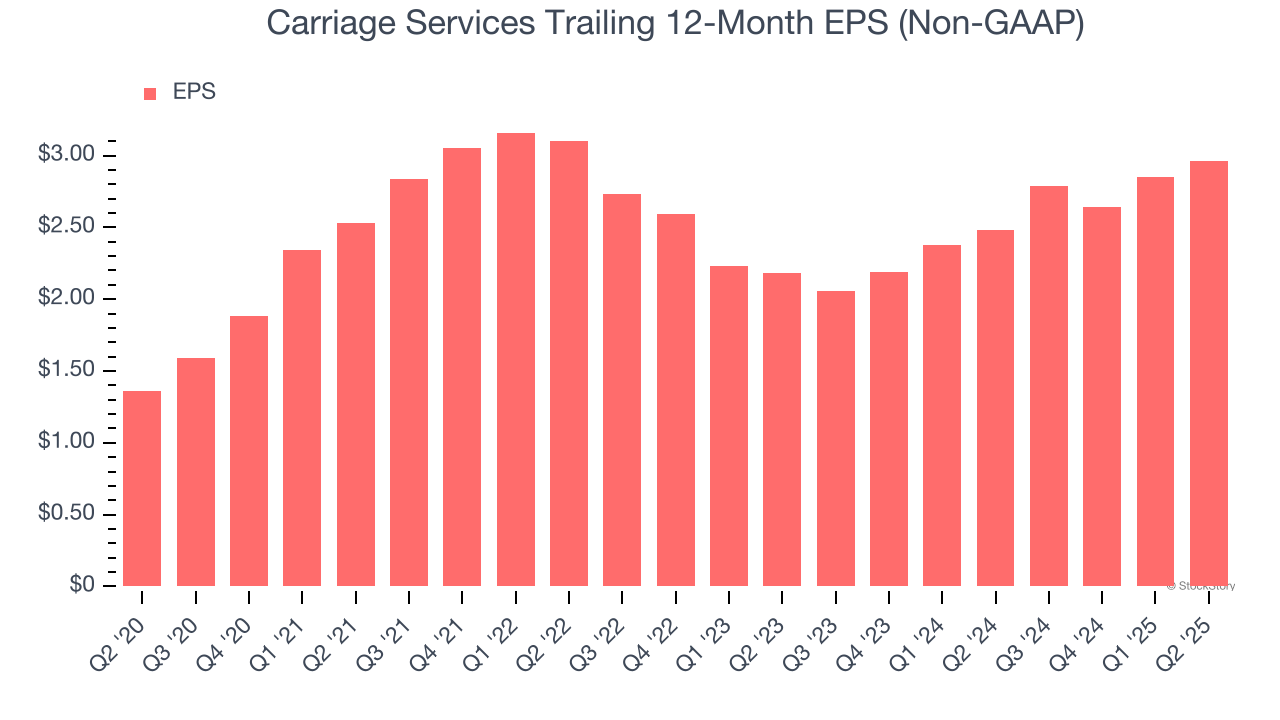

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Carriage Services’s EPS grew at a remarkable 16.8% compounded annual growth rate over the last five years, higher than its 6.9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q2, Carriage Services reported adjusted EPS at $0.74, up from $0.63 in the same quarter last year. This print beat analysts’ estimates by 1.8%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Carriage Services’s Q2 Results

Revenue, EBITDA, and EPS beat in the quarter. It was also great to see Carriage Services’s full-year revenue guidance top analysts’ expectations. Overall, this print had some key positives. The stock remained flat at $46.21 immediately following the results.

Is Carriage Services an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.