Low code software development platform provider Appian (Nasdaq: APPN) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 16.5% year on year to $170.6 million. Guidance for next quarter’s revenue was better than expected at $174 million at the midpoint, 1.8% above analysts’ estimates. Its non-GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Appian? Find out by accessing our full research report, it’s free.

Appian (APPN) Q2 CY2025 Highlights:

- Revenue: $170.6 million vs analyst estimates of $160 million (16.5% year-on-year growth, 6.7% beat)

- Adjusted EPS: $0 vs analyst estimates of -$0.13 (significant beat)

- Adjusted Operating Income: $5.61 billion vs analyst estimates of -$5.9 million (3,285% margin, significant beat)

- The company lifted its revenue guidance for the full year to $699 million at the midpoint from $684 million, a 2.2% increase

- Management raised its full-year Adjusted EPS guidance to $0.32 at the midpoint, a 45.5% increase

- EBITDA guidance for the full year is $52 million at the midpoint, above analyst estimates of $43.62 million

- Operating Margin: -6.4%, up from -26.8% in the same quarter last year

- Free Cash Flow was -$3.09 million, down from $44.32 million in the previous quarter

- Net Revenue Retention Rate: 111%, down from 112% in the previous quarter

- Market Capitalization: $2 billion

“Appian AI drove strong financial results in the second quarter of 2025, with higher prices and a larger pipeline,” said Matt Calkins, CEO & Founder.

Company Overview

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Revenue Growth

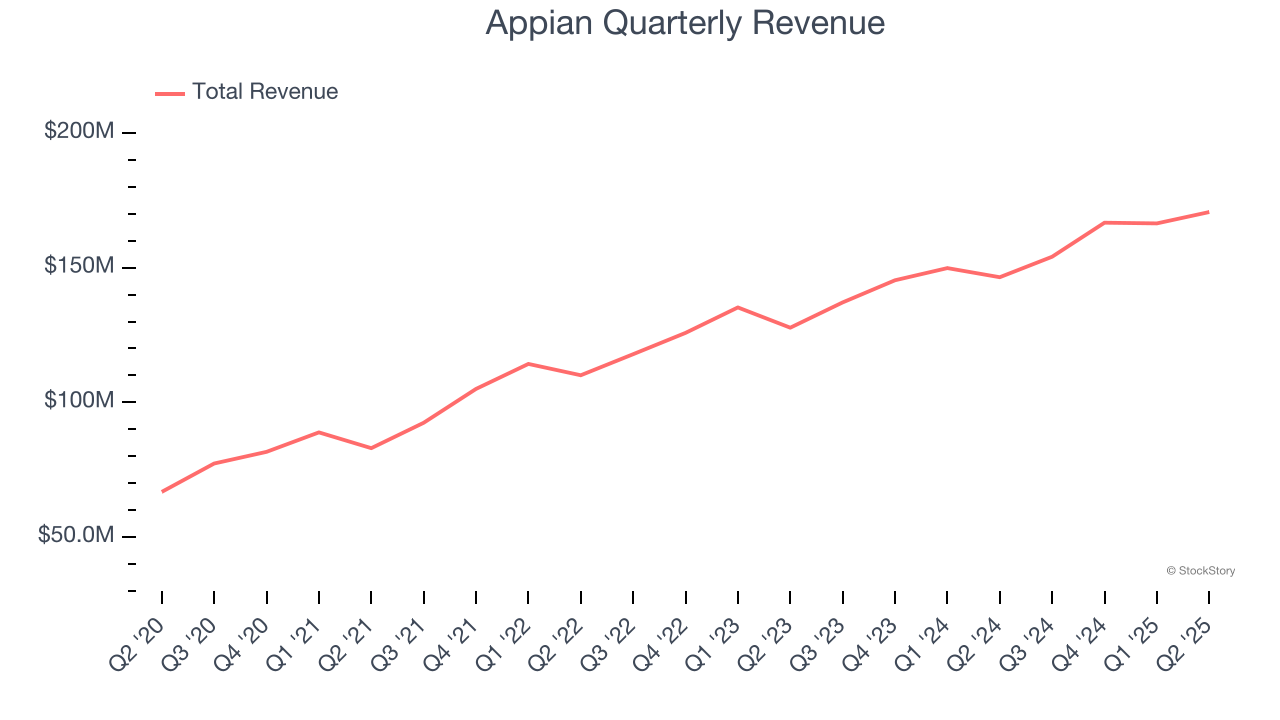

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Appian grew its sales at a 16% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Appian reported year-on-year revenue growth of 16.5%, and its $170.6 million of revenue exceeded Wall Street’s estimates by 6.7%. Company management is currently guiding for a 12.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Retention

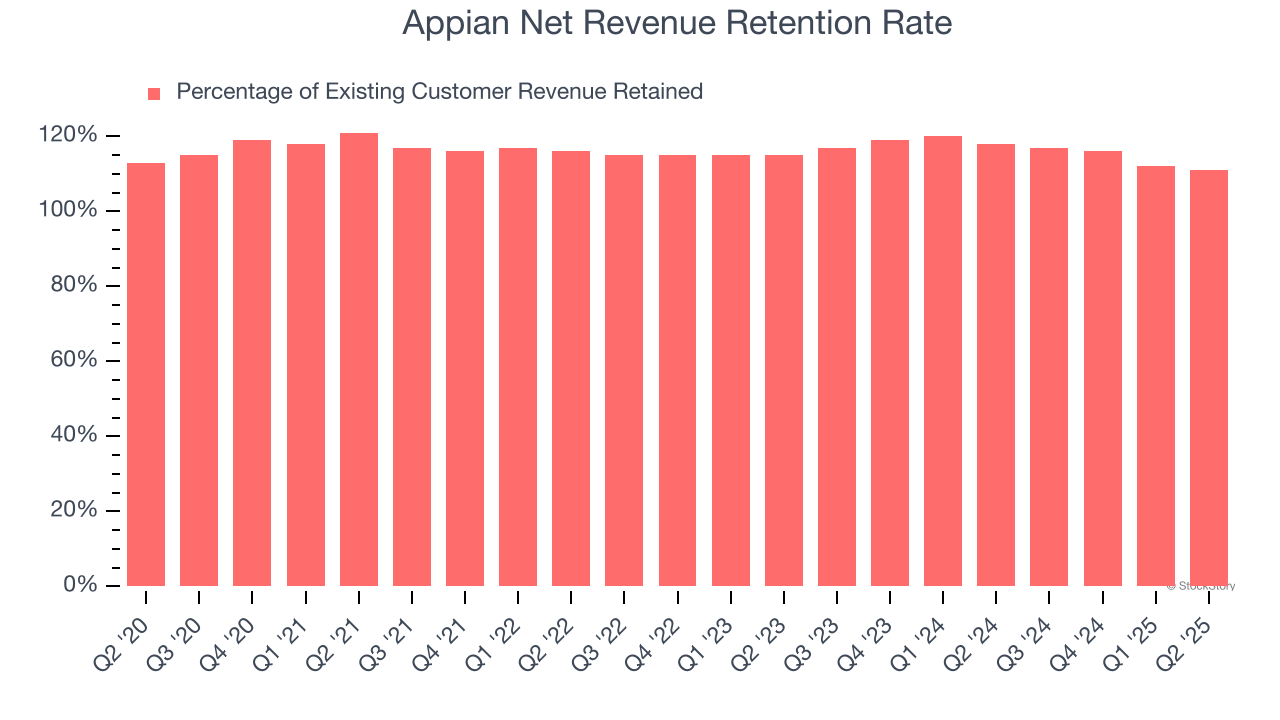

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Appian’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 114% in Q2. This means Appian would’ve grown its revenue by 14% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Appian still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Appian’s Q2 Results

We were impressed by how significantly Appian blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 8.3% to $29.17 immediately following the results.

Appian may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.