Marine infrastructure company Orion (NYSE:ORN) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 6.8% year on year to $205.3 million. The company expects the full year’s revenue to be around $825 million, close to analysts’ estimates. Its non-GAAP profit of $0.07 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Orion? Find out by accessing our full research report, it’s free.

Orion (ORN) Q2 CY2025 Highlights:

- Revenue: $205.3 million vs analyst estimates of $198.3 million (6.8% year-on-year growth, 3.5% beat)

- Adjusted EPS: $0.07 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $10.98 million vs analyst estimates of $9.73 million (5.3% margin, 12.9% beat)

- The company reconfirmed its revenue guidance for the full year of $825 million at the midpoint

- Adjusted EPS guidance for the full year is $0.14 at the midpoint, beating analyst estimates by 19.1%

- EBITDA guidance for the full year is $44 million at the midpoint, below analyst estimates of $44.4 million

- Operating Margin: 1.7%, up from -1.5% in the same quarter last year

- Free Cash Flow was $3.31 million, up from -$19.97 million in the same quarter last year

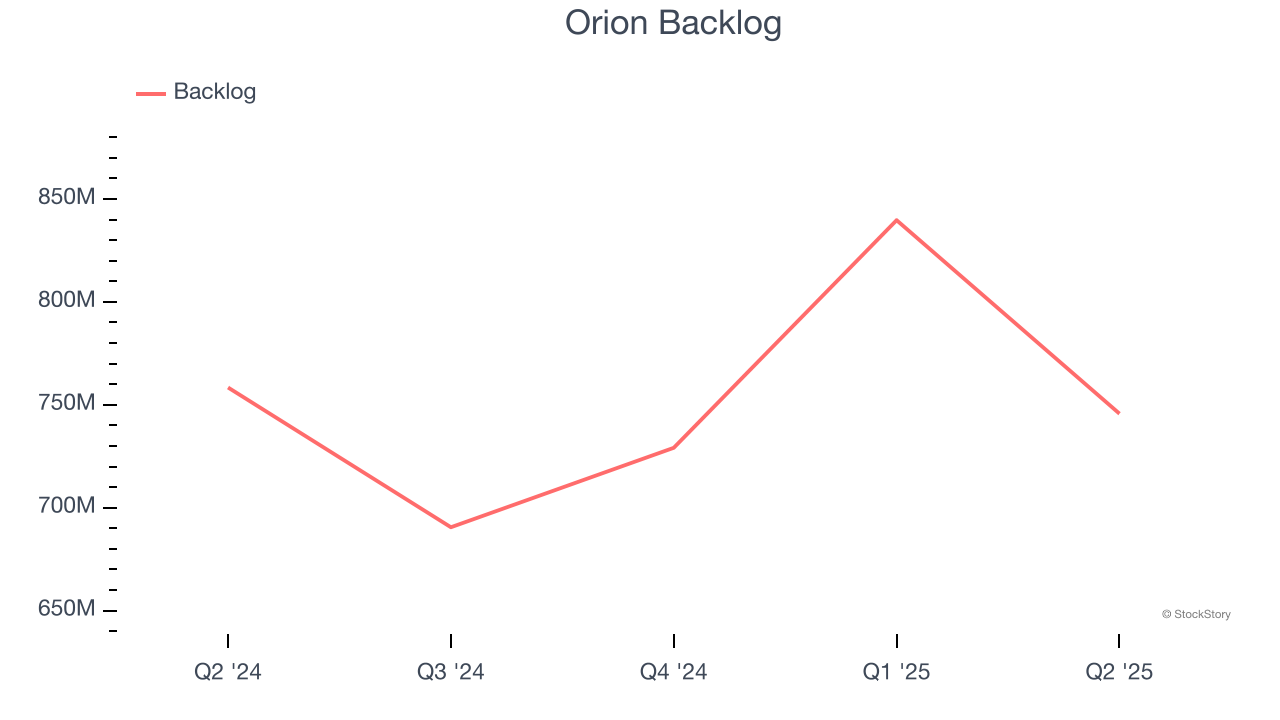

- Backlog: $745.7 million at quarter end, down 1.7% year on year

- Market Capitalization: $376.9 million

“We delivered another strong performance in the second quarter with revenue increasing 7% to $205 million and Adjusted EBITDA doubling to $11 million from the second quarter last year. Sequentially, results were also strong with revenue up 9% over the first quarter and Adjusted EBITDA up 34%. Our results were primarily driven by new contract awards in both segments and reflect our commitment to disciplined, profitable growth,” said Travis Boone, Chief Executive Officer of Orion Group Holdings.

Company Overview

Established in 1994, Orion (NYSE:ORN) provides construction services for marine infrastructure and industrial projects.

Revenue Growth

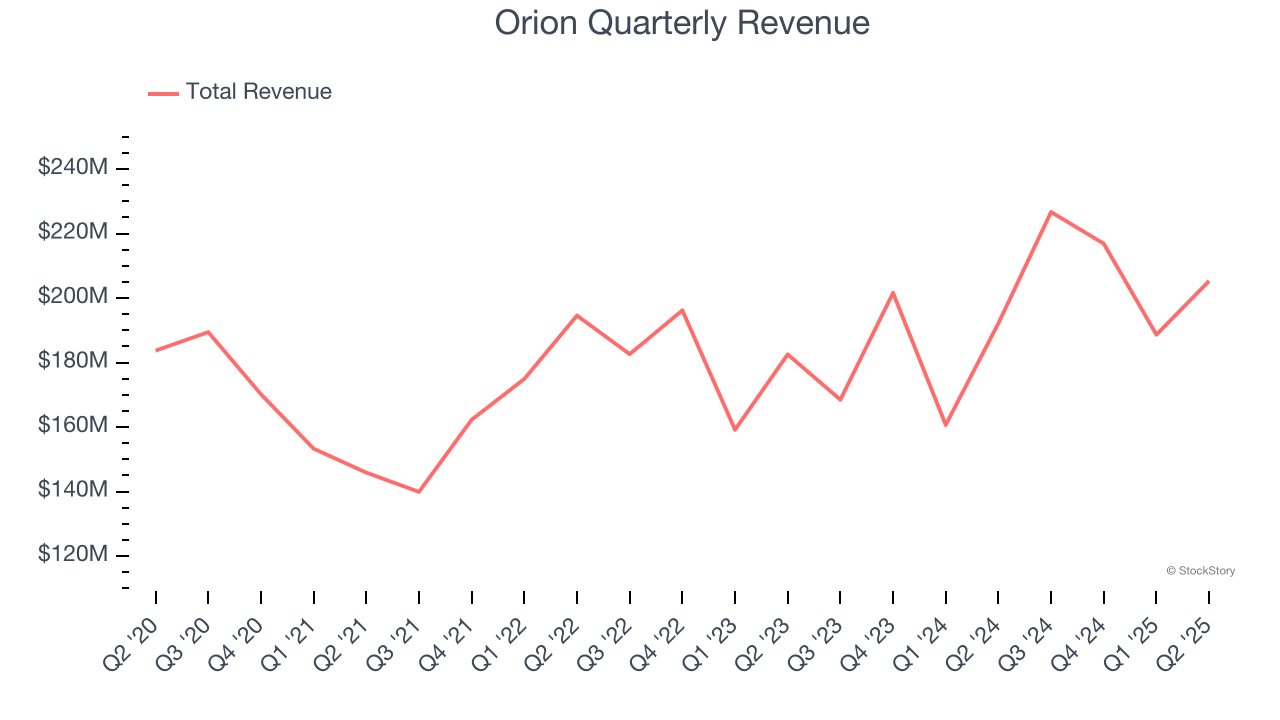

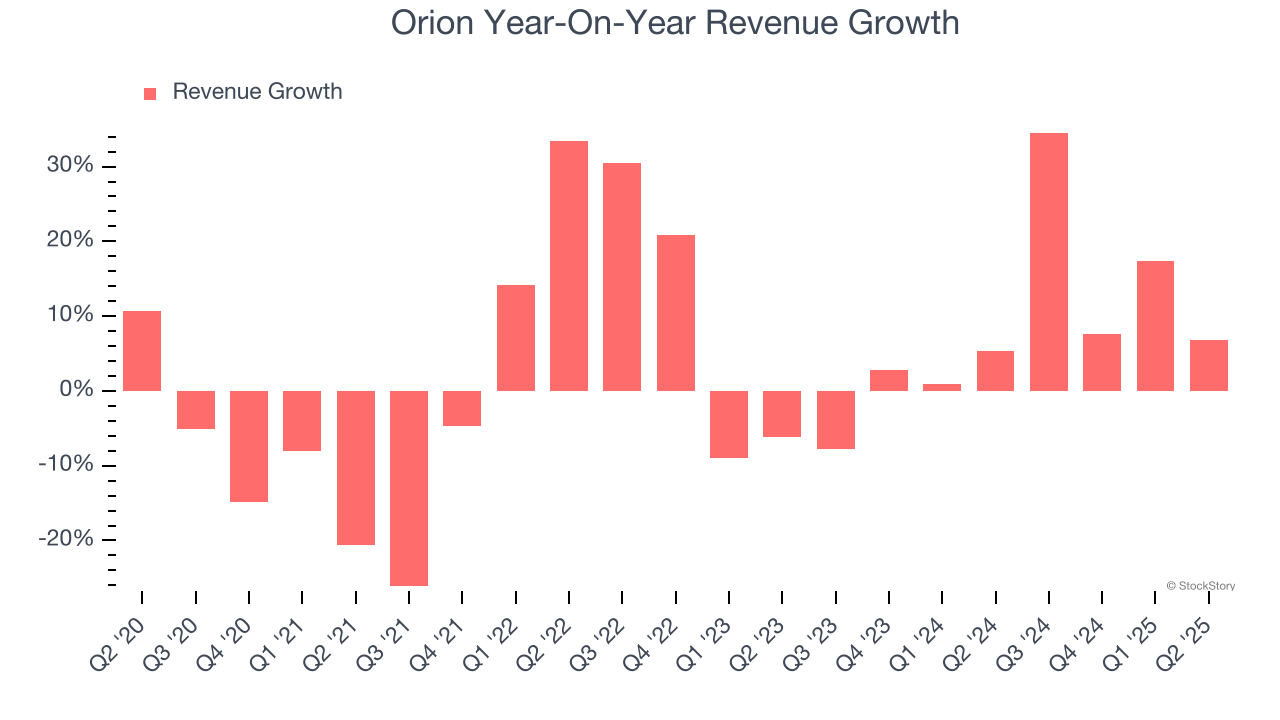

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Orion grew its sales at a sluggish 2.2% compounded annual growth rate. This was below our standards and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Orion’s annualized revenue growth of 7.8% over the last two years is above its five-year trend, suggesting some bright spots.

Orion also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Orion’s backlog reached $745.7 million in the latest quarter and averaged 1.7% year-on-year declines over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Orion was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Orion reported year-on-year revenue growth of 6.8%, and its $205.3 million of revenue exceeded Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

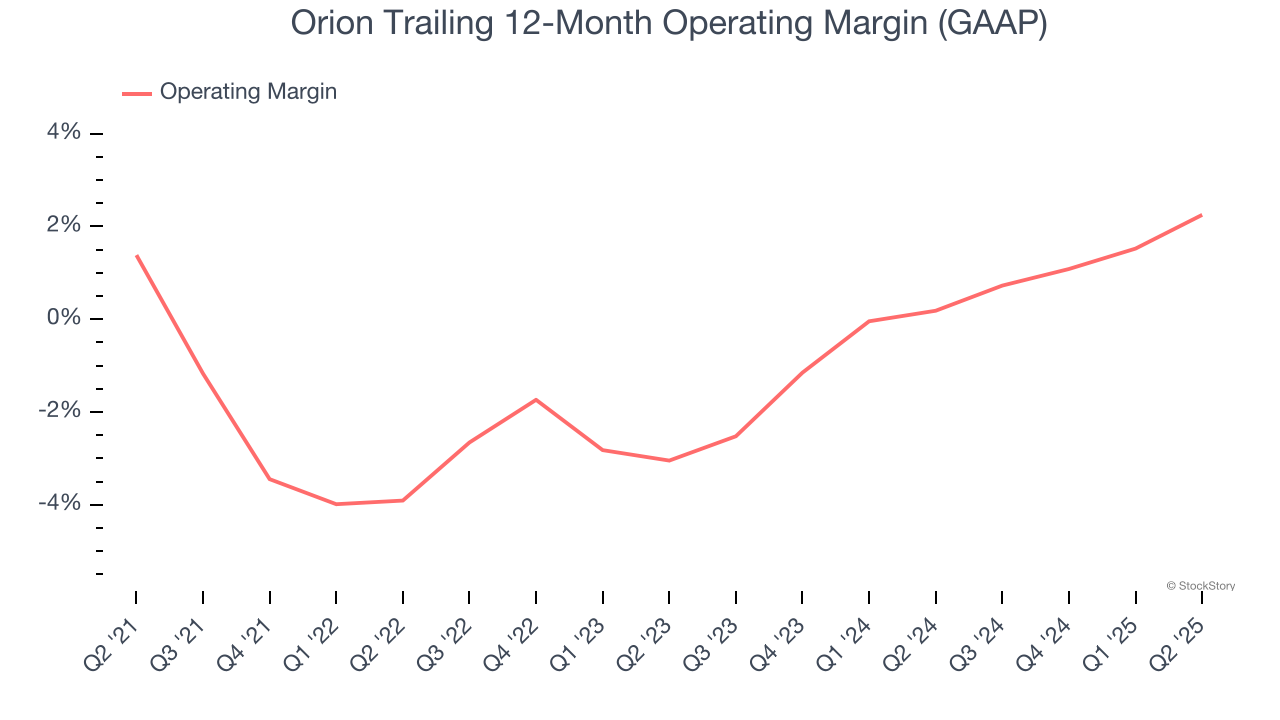

Orion’s operating margin has been trending up over the last 12 months, leading to break even profits over the last five years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Orion’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q2, Orion generated an operating margin profit margin of 1.7%, up 3.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

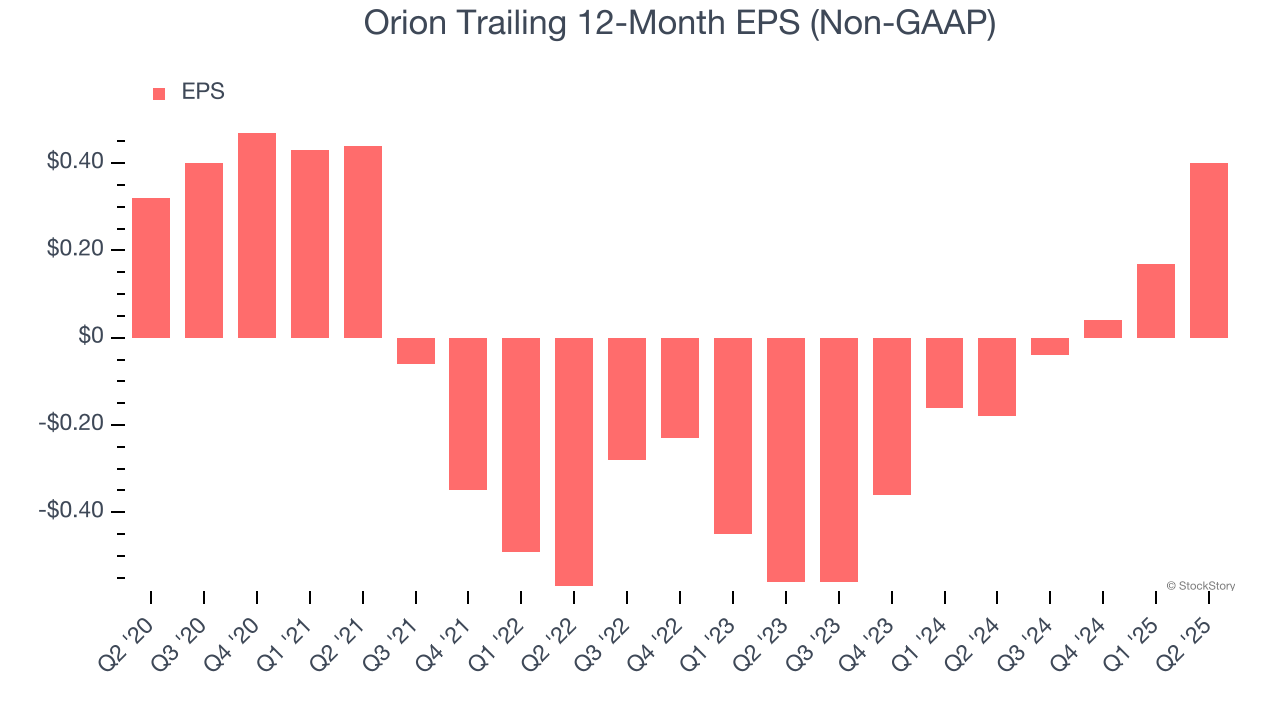

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Orion’s EPS grew at an unimpressive 4.6% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Orion, its two-year annual EPS growth of 64.8% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, Orion reported EPS at $0.07, up from negative $0.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Orion to perform poorly. Analysts forecast its full-year EPS of $0.40 will hit $0.20.

Key Takeaways from Orion’s Q2 Results

We were impressed by how significantly Orion blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 6.2% to $9.96 immediately after reporting.

Indeed, Orion had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.