Scientific consulting firm Exponent (NASDAQ:EXPO) announced better-than-expected revenue in Q3 CY2025, with sales up 17.6% year on year to $147.1 million. Its GAAP profit of $0.55 per share was 8.5% above analysts’ consensus estimates.

Is now the time to buy Exponent? Find out by accessing our full research report, it’s free for active Edge members.

Exponent (EXPO) Q3 CY2025 Highlights:

- Revenue: $147.1 million vs analyst estimates of $131.8 million (17.6% year-on-year growth, 11.7% beat)

- EPS (GAAP): $0.55 vs analyst estimates of $0.51 (8.5% beat)

- Adjusted EBITDA: $38.84 million vs analyst estimates of $36.32 million (26.4% margin, 6.9% beat)

- Operating Margin: 19.7%, in line with the same quarter last year

- Market Capitalization: $3.30 billion

“Exponent delivered a strong third quarter, achieving double digit net revenue growth that reflects the strength of our diversified portfolio and our ability to deliver value across industries,” stated Dr. Catherine Corrigan, President and Chief Executive Officer.

Company Overview

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent (NASDAQ:EXPO) is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $541.2 million in revenue over the past 12 months, Exponent is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

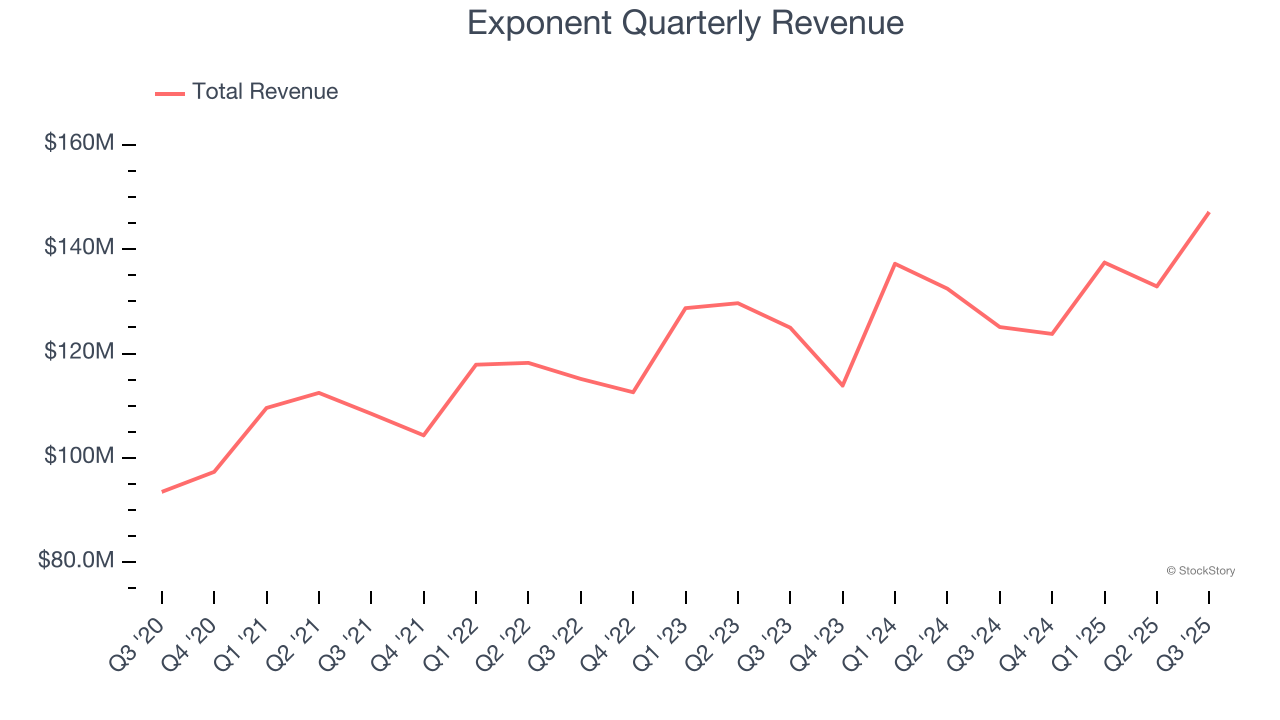

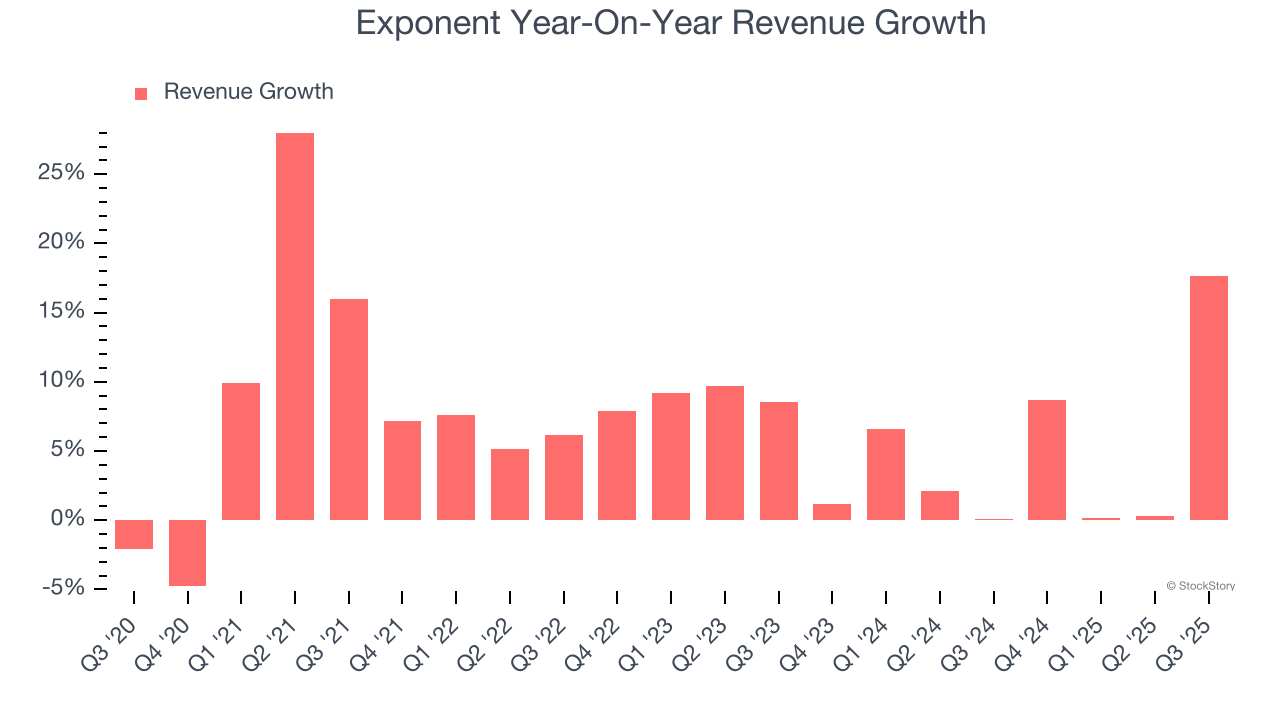

As you can see below, Exponent’s 7.1% annualized revenue growth over the last five years was solid. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Exponent’s recent performance shows its demand has slowed as its annualized revenue growth of 4.5% over the last two years was below its five-year trend.

This quarter, Exponent reported year-on-year revenue growth of 17.6%, and its $147.1 million of revenue exceeded Wall Street’s estimates by 11.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

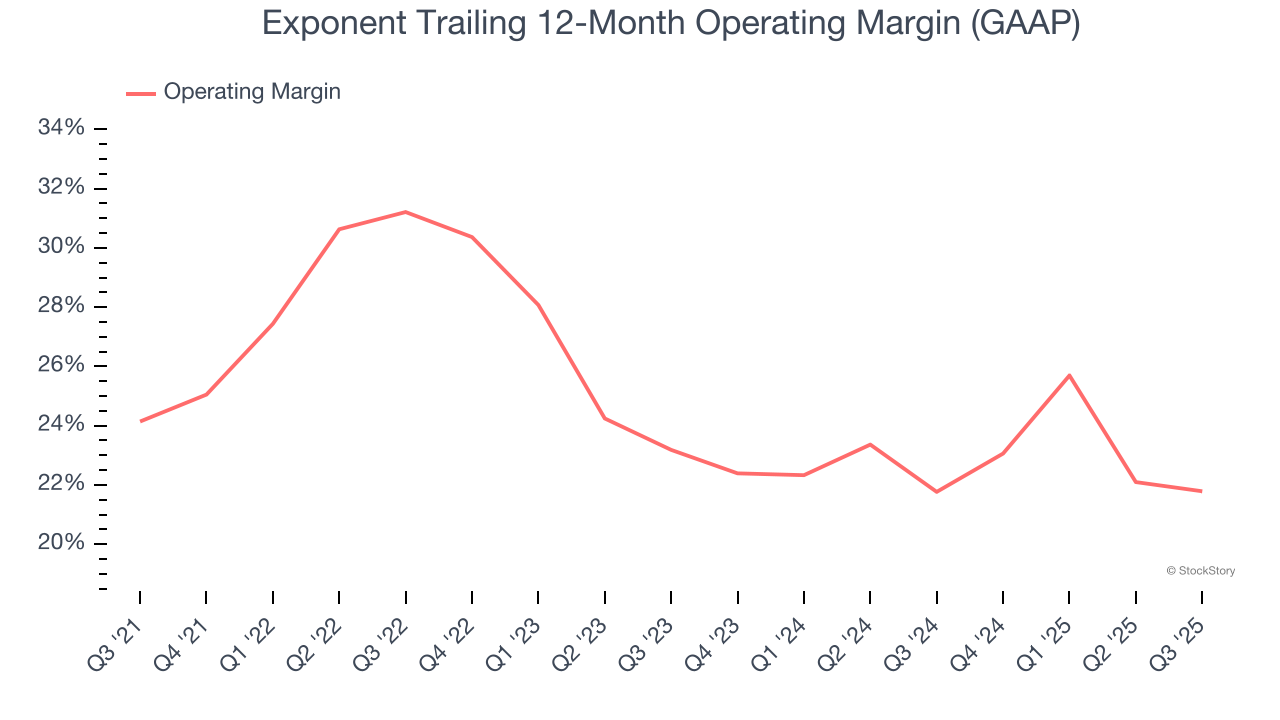

Exponent has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.2%.

Analyzing the trend in its profitability, Exponent’s operating margin decreased by 2.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Exponent generated an operating margin profit margin of 19.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

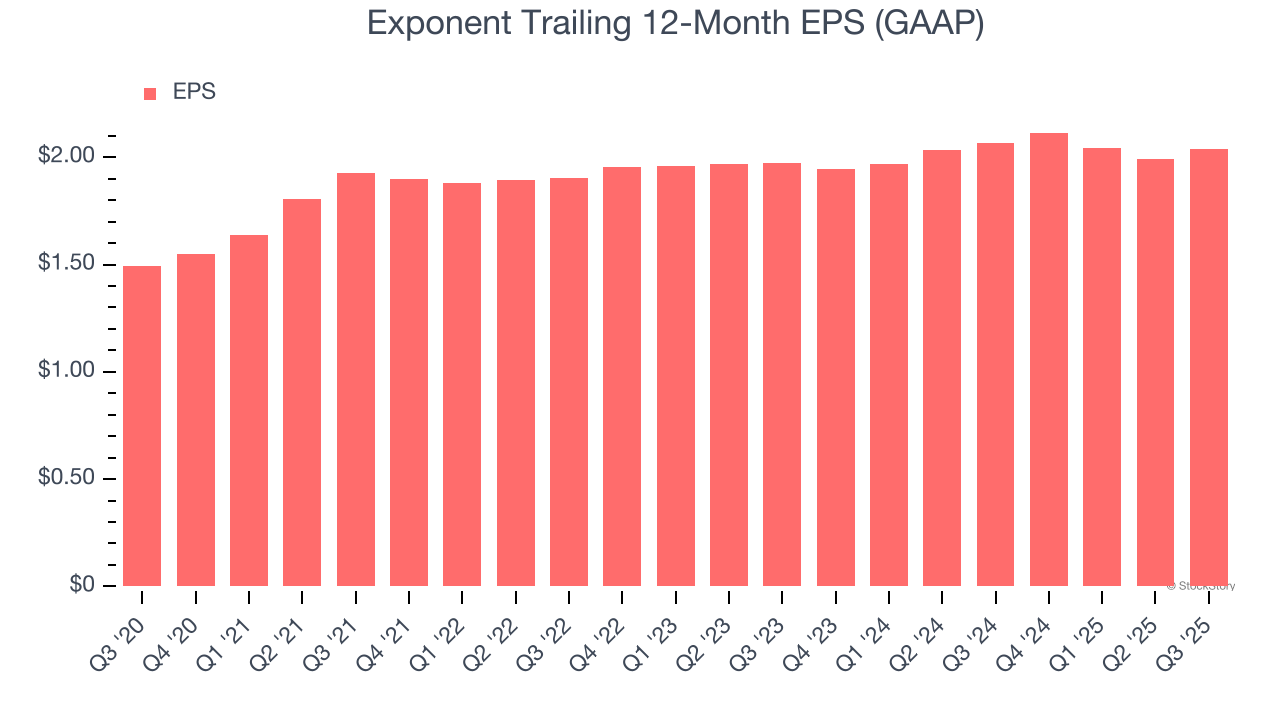

Exponent’s unimpressive 6.4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Exponent’s two-year annual EPS growth of 1.6% was subpar and lower than its 4.5% two-year revenue growth.

We can take a deeper look into Exponent’s earnings to better understand the drivers of its performance. While we mentioned earlier that Exponent’s operating margin was flat this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Exponent reported EPS of $0.55, up from $0.50 in the same quarter last year. This print beat analysts’ estimates by 8.5%. Over the next 12 months, Wall Street expects Exponent’s full-year EPS of $2.04 to grow 3.1%.

Key Takeaways from Exponent’s Q3 Results

We were impressed by how significantly Exponent blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $66.82 immediately following the results.

Sure, Exponent had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.